Supporting SF Schools With REAL Numbers

Transparent Accurate Data Should Inform SFUSD Budget Decisions

There is a common perception that the San Francisco Unified School District (SFUSD) is always about to run out of money. SFUSD says that we have a “structural deficit”—a consistent budget gap where yearly spending always exceeds revenue. The District has consistently maintained that this structural deficit will lead to bankruptcy and state takeover. No one wants state takeover. And if we had a structural deficit, it would be important to take it seriously.

But does SFUSD really have a structural deficit?

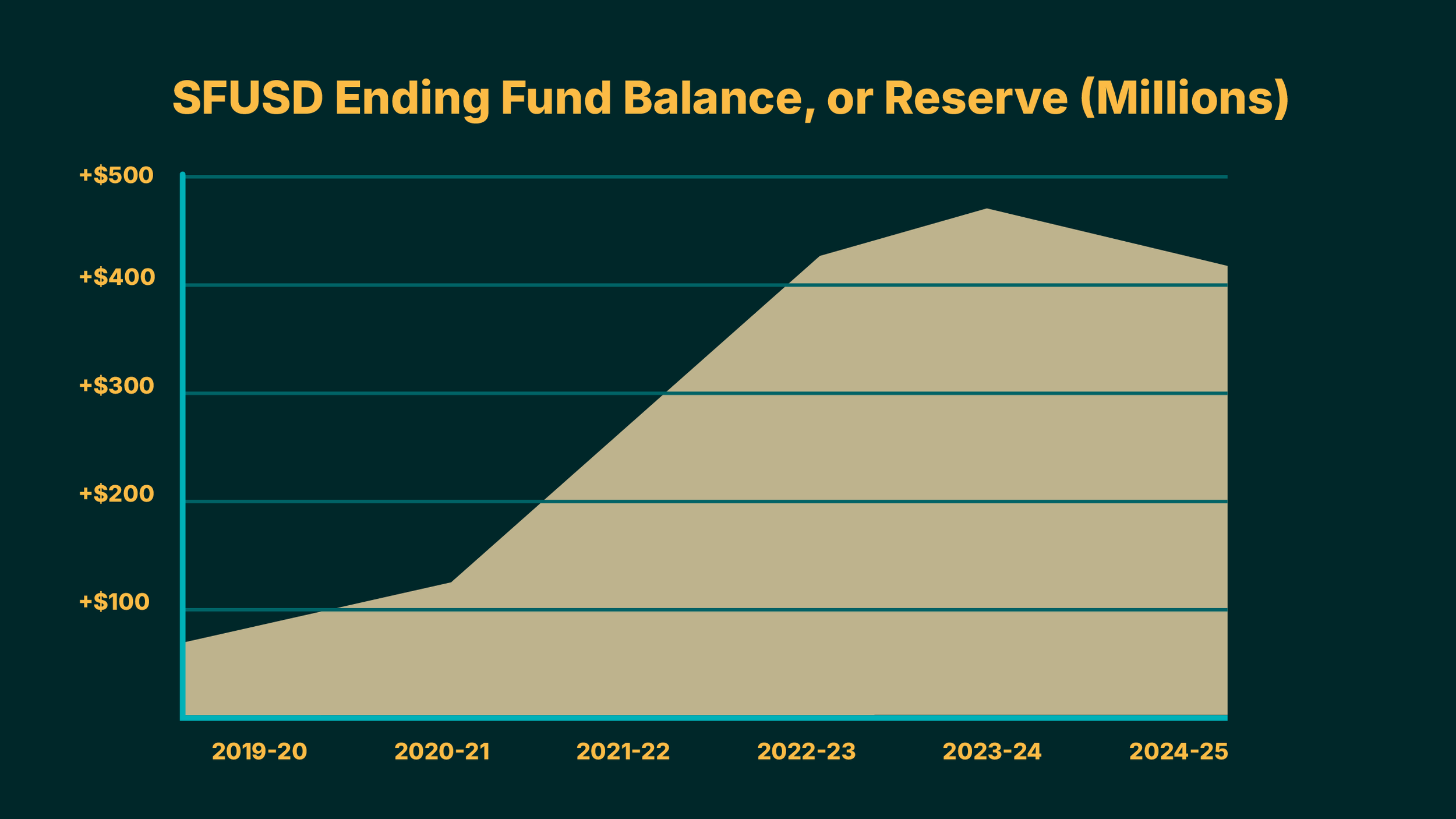

The truth is, as of June 30, 2025, SFUSD has a “fund balance” or reserve, of $429 million.

How did this happen? For years, SFUSD has been predicting large budget deficits—but the actual reality, once all the revenue and expenses are tallied up, is that we’ve been spending less than we receive in tax revenue, resulting in not a deficit but a surplus.

All of these yearly surpluses have built up into a huge reserve fund balance of $429 million. This is an enormous stockpile of taxpayer dollars—nearly 35% of SFUSD’s entire General Fund. (The legally required reserve amount for school districts of SFUSD’s size is 2%.)

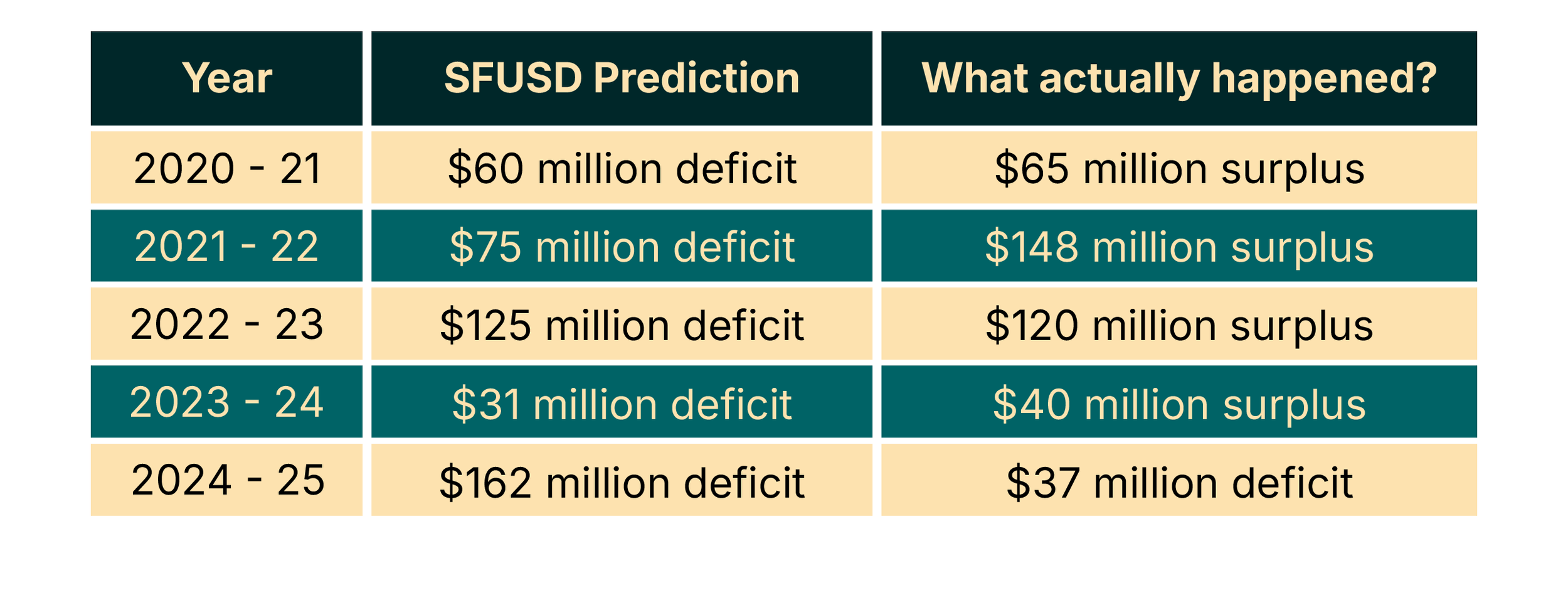

SFUSD’s inaccurate budget predictions

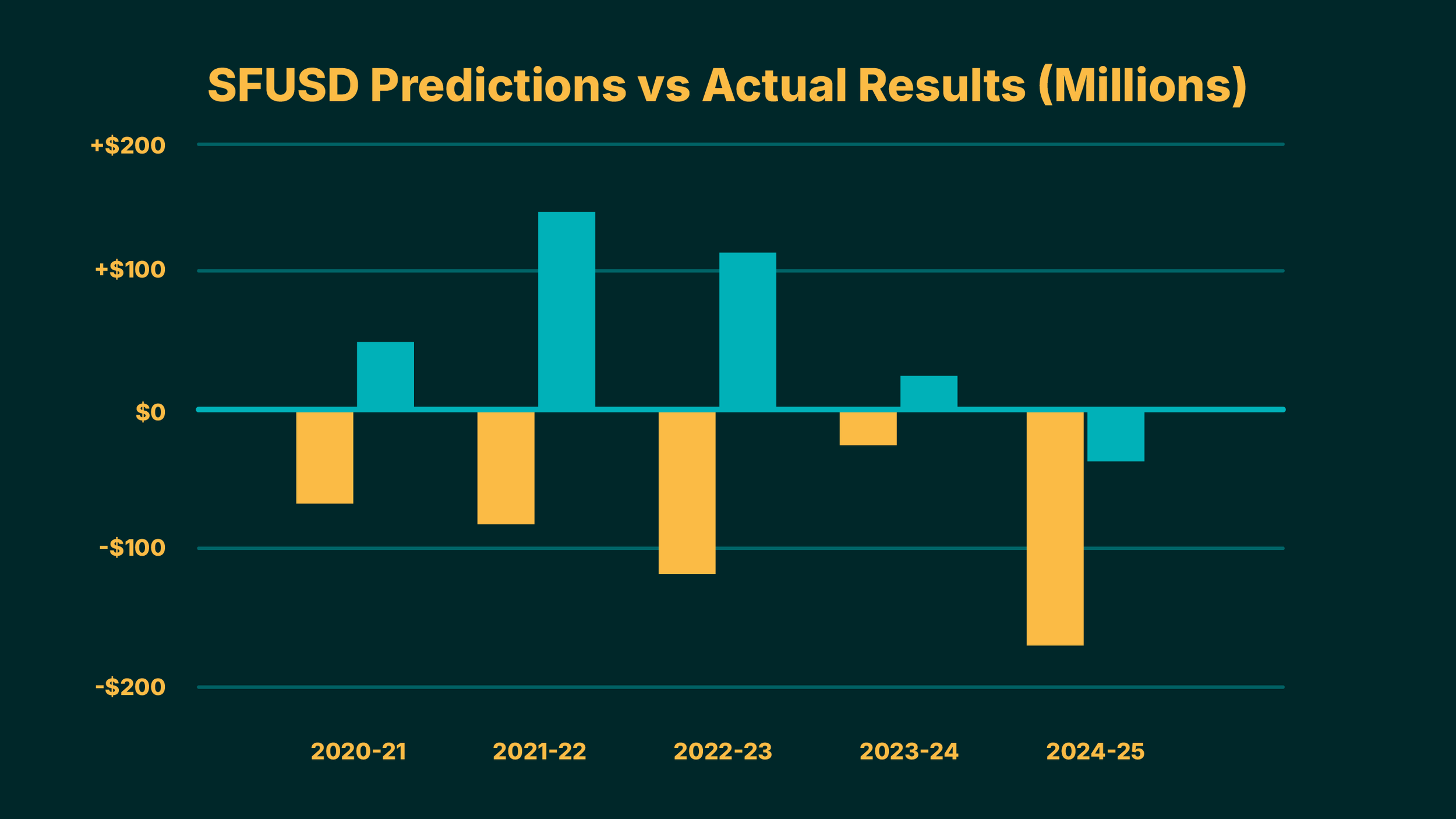

Over the past five years, SFUSD has predicted deficits totalling $453 million—and yet instead of a deficit we’ve had a total surplus of $336 million, which was added to the fund balance. That’s an average surplus of $67 million a year.

This chart shows the yearly differences between SFUSD’s projected deficit and the actual fund balance results:

This graph shows how incorrect the SFUSD predictions have been compared to actual results for the past five fiscal years:

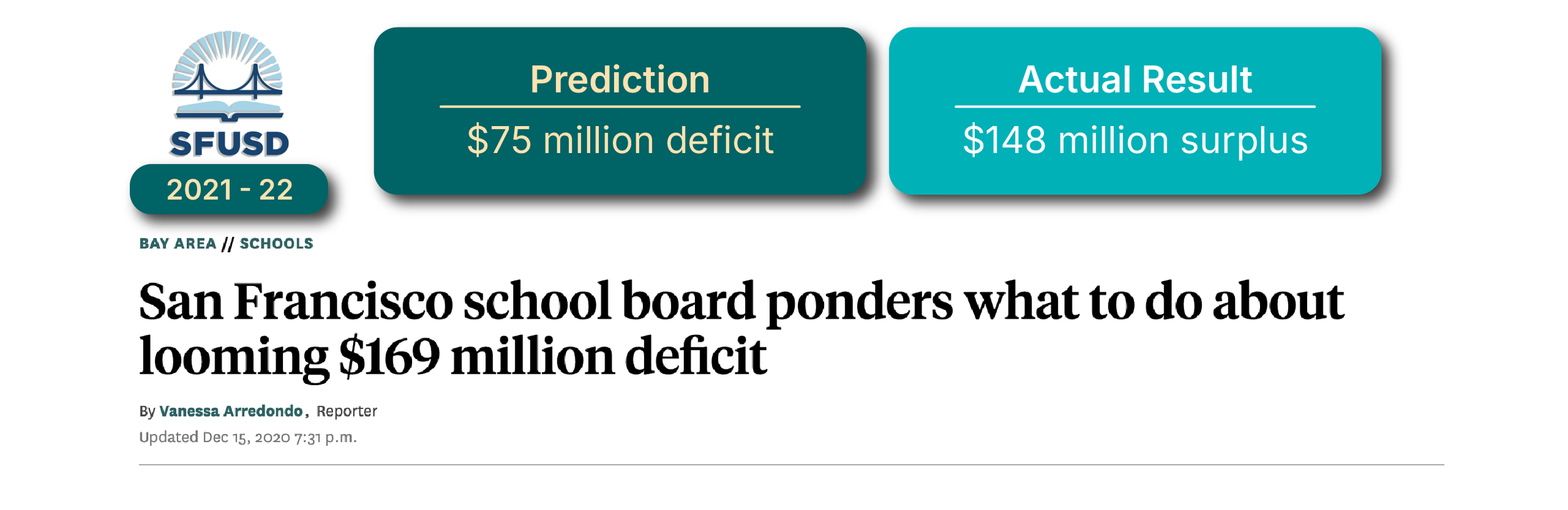

SFUSD’S Media Narrative

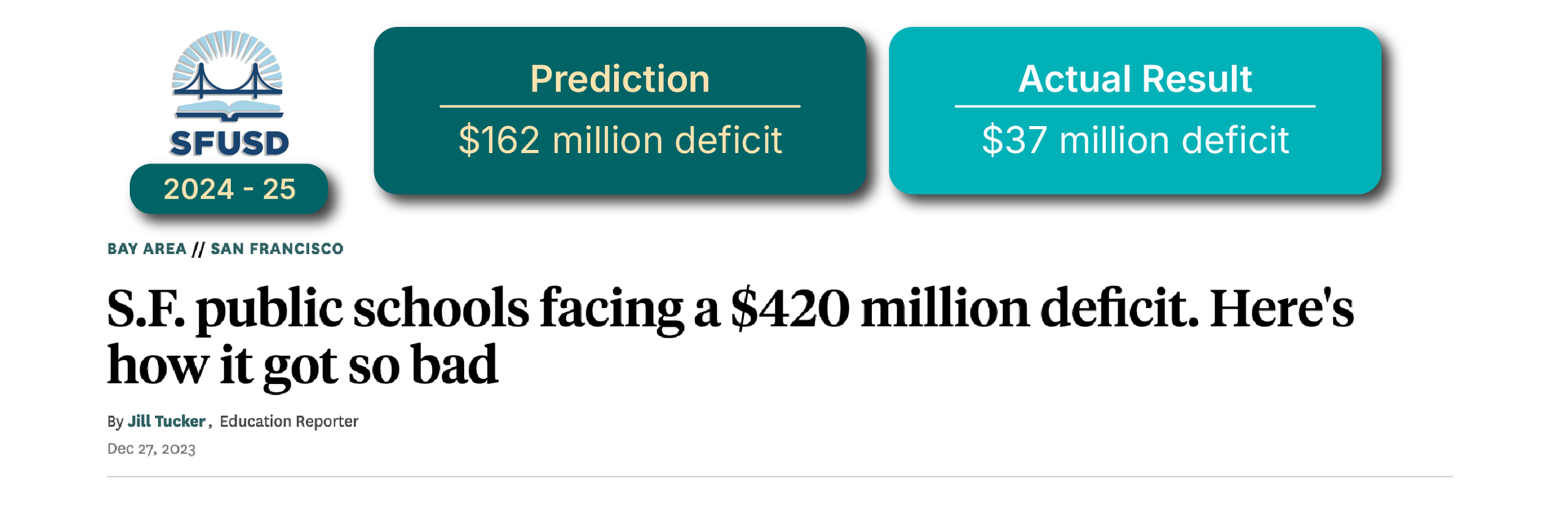

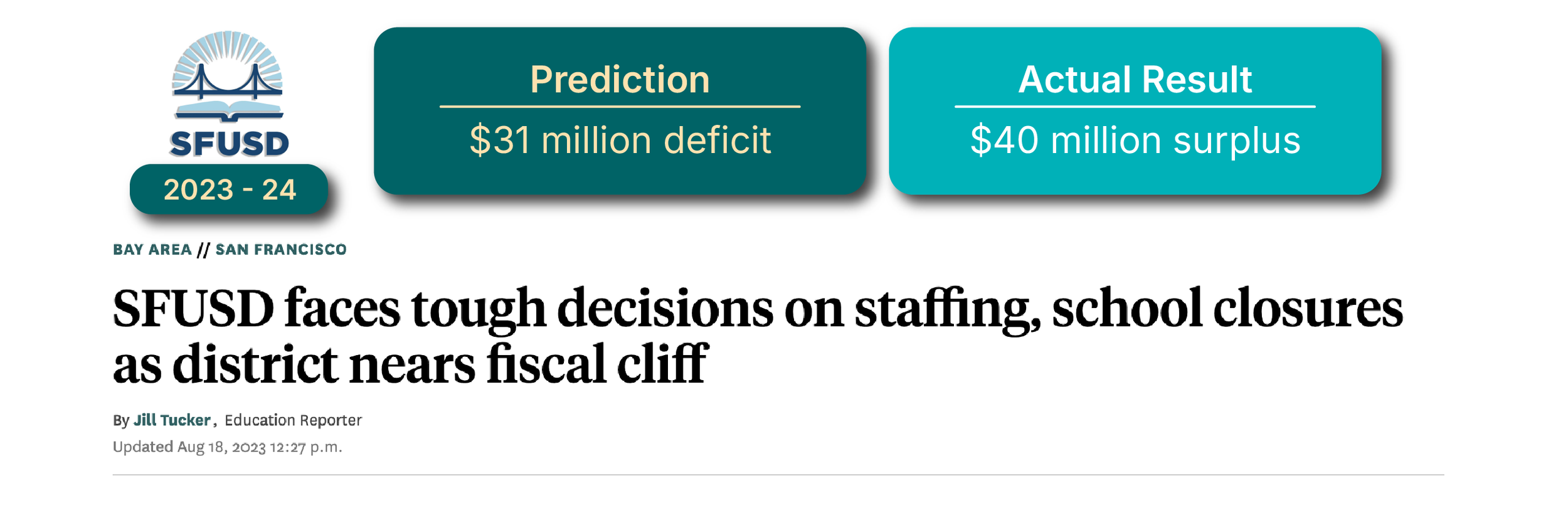

SFUSD’s wildly inaccurate budget projections have been amplified in the media, resulting in a consistent “sky is falling” narrative, while the actual surpluses have rarely been noted in public. In some reporting, media outlets have combined multiple years of projected deficits to produce even more fear-mongering headlines.

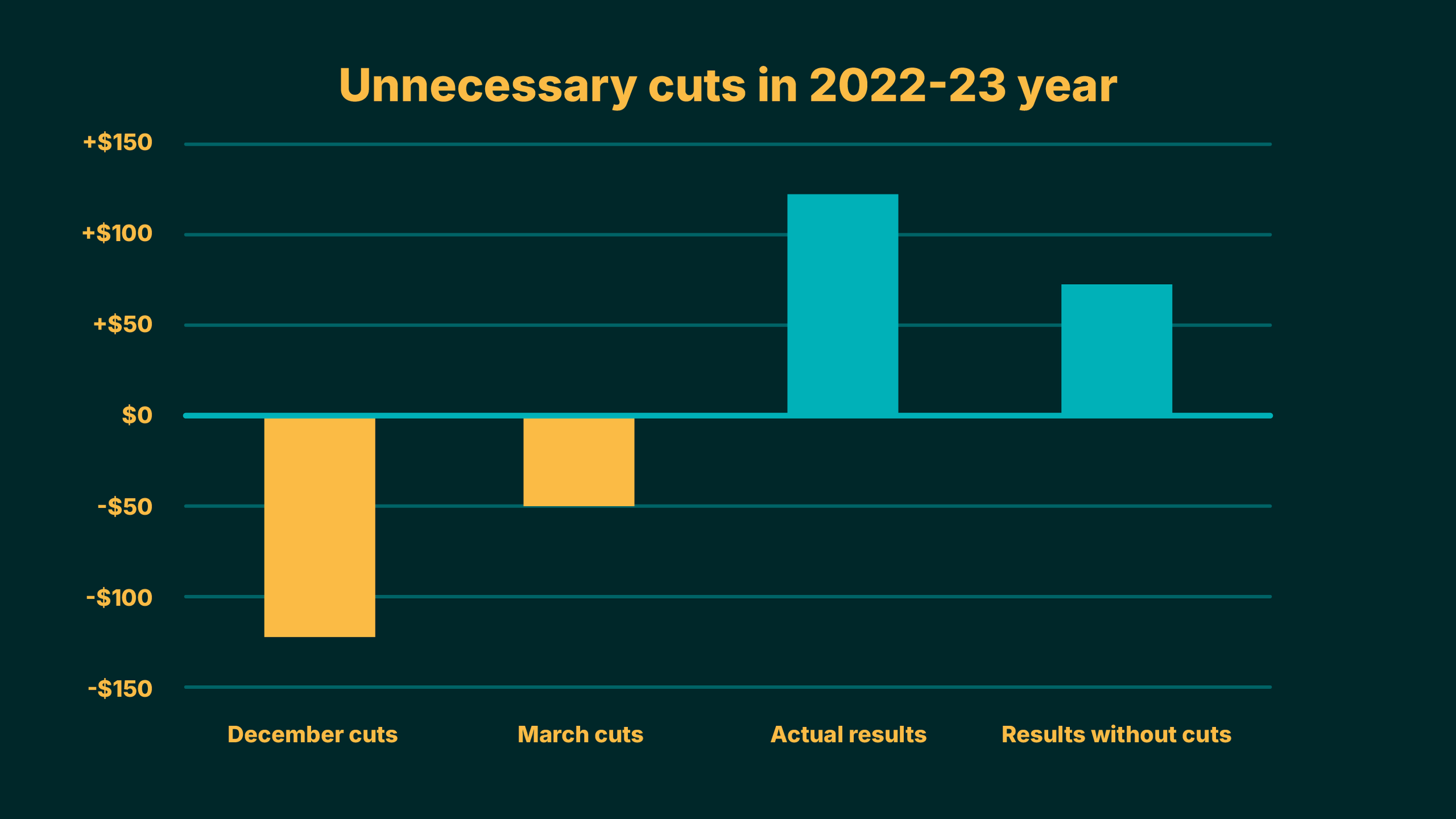

Impact on Students: 2022 Case Study

Let’s take a closer look at the 2022-23 school year to understand how SFUSD’s inaccurate budget projections happened, and how they impacted our schools and students. In December 2021, as budget conversations for the following year began, SFUSD was predicting a $125 million deficit. The Board of Education approved a budget stabilization plan with $90 million in cuts, including significant reductions to school site budgets.

By March, the proposed cuts had been reduced to $50 million, still a significant amount, and the Board voted to approve over 250 layoffs of teachers and staff in order to “balance the budget.”

But a year later, when the books were closed on the 2022-23 year, it turned out that the budget had already been balanced: SFUSD ended the year with a $120 million surplus— enough to avoid all of the cuts twice over.

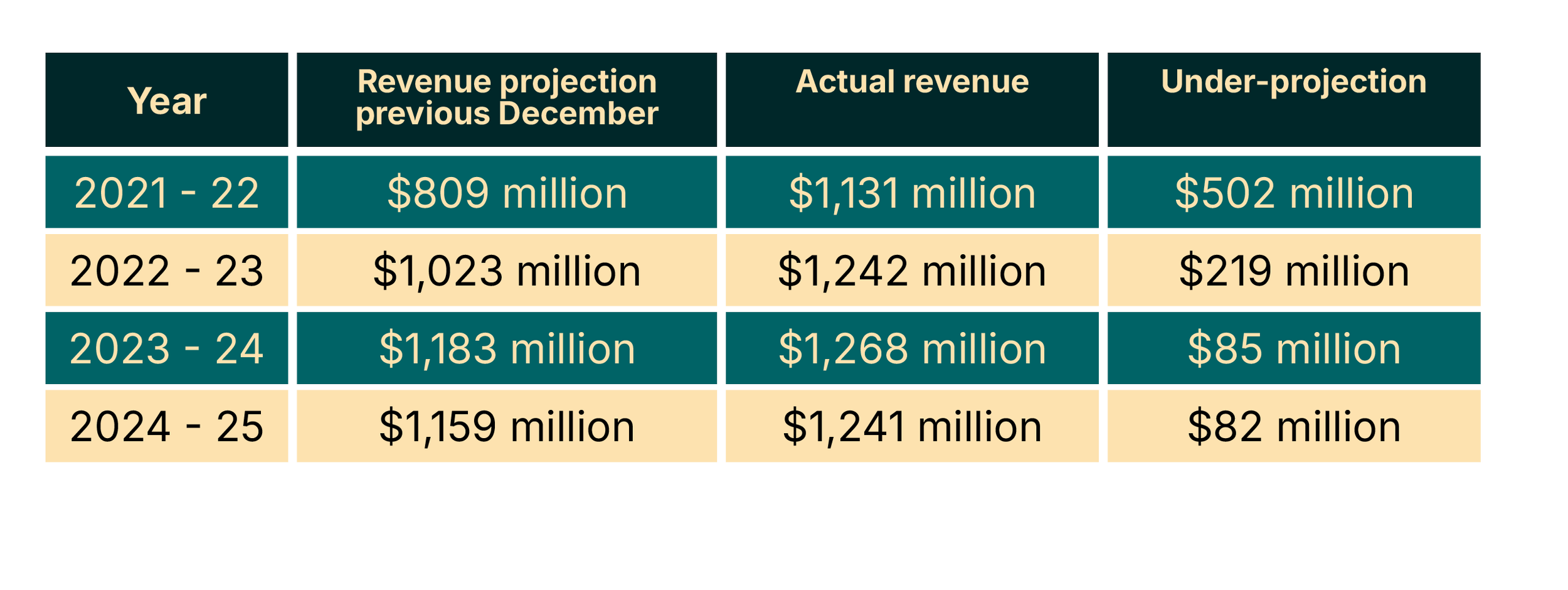

Under-estimation of revenue

How did SFUSD make such inaccurate projections? There is a common perception that much of the variance between SFUSD budgets and actuals comes from unfilled positions—that is, positions that are budgeted but not hired for, resulting in lower spending than was budgeted. While this certainly occurs, the District’s own data shows that the biggest differences are actually on the revenue side, with the District under-predicting revenues by massive amounts. This under-projection supports a “sky is falling” narrative that doesn’t add up when actual revenue turns out to be much greater.

SFUSD has under-projected revenue across local, state, and federal funding sources. The specific source of the under-projection of revenue has varied from year-to-year, but the common pattern is that predictions are always dire between December and March, when school-site budget conversations happen and leading up to the state deadline for potential layoffs.

State Oversight

Not only do these inaccurate predictions of massive deficits lead to unnecessary cuts that negatively impact students and the stockpiling of money that could have supported student learning, the apocalyptic financial predictions also resulted in state intervention in 2021.

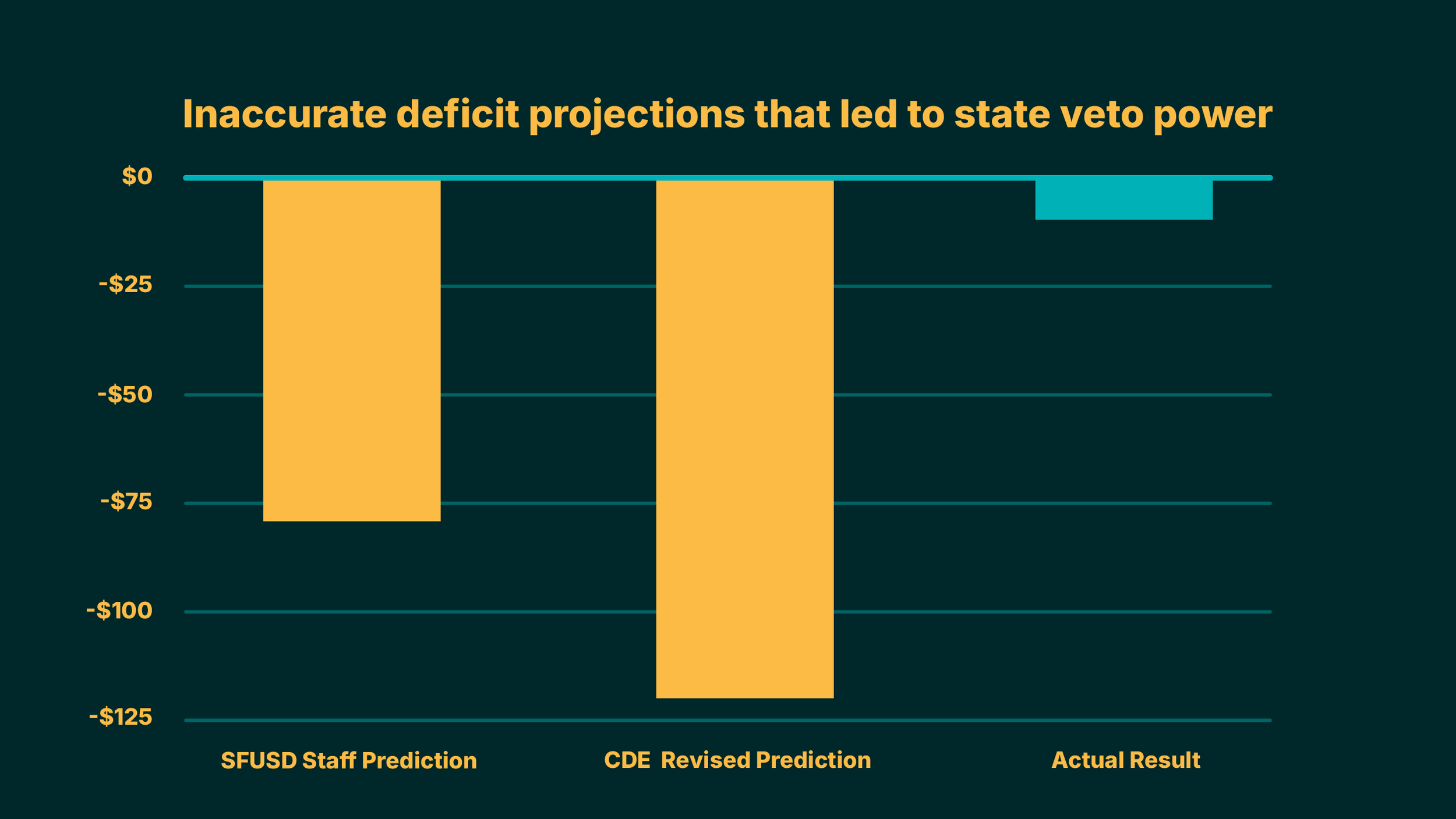

Then, in May 2024, state officials wrote to SFUSD saying they would increase their oversight to include veto power over Board decisions, largely because they felt that SFUSD staff had not been pessimistic enough in their upcoming budget predictions.

For the upcoming 2024-25 school year, SFUSD staff was predicting a $77 million deficit in the Unrestricted General Fund, but the California Department of Education (CDE) said that a more accurate projection would be a $122 million deficit. (Note that these figures only include unrestricted funds, or about half of SFUSD’s overall budget—so they don’t match the overall numbers cited above.)

It turns out that the CDE predictions were even more inaccurate than SFUSD’s. When actual spending from 2024-25 was tallied up, unrestricted funds showed a tiny deficit of $6 million, almost a rounding error with over $400 million sitting in SFUSD’s bank account.

Conclusion

When we look at the actual data, SFUSD appears to not have a history of structural deficit, but rather of structural surplus—along with structural dysfunction in how we do budgets.

For years, SFUSD has been predicting massive deficits during the budgeting season from December to March. SFUSD’s revenue projections are especially inaccurate. The media has amplified SFUSD’s doomsday narrative. And often the Board of Education, relying on the predictions of finance staff, has approved cuts that ultimately harm our schools and students.

But the “sky is falling” predictions never come to pass. Instead, over the past five years, while SFUSD staff have predicted deficits totalling $453 million, we’ve actually seen a total surplus of $336 million, or an average surplus of $67 million surplus a year.

These large surpluses have built up SFUSD’s reserve to $429 million, or 35% of the General Fund. That’s an enormous stockpile of taxpayer dollars that was intended to be spent on our kids. If we were to continue forward with last year’s $37 million deficit, it would take over a decade to deplete this reserve.

This year, once again, SFUSD is predicting a deficit and proposing painful cuts to schools. These cuts could seriously undermine staff stability and make it much more difficult to achieve our academic outcomes. They could drive families away from public schools, leading to enrollment declines and lost revenue.

All of the evidence from the recent past suggests that we ought to be skeptical of the District’s deficit predictions. As concerned members of the SFUSD community, we must call for accurate, evidence-based, and independently verified budget projections, especially on the revenue side. We must develop a responsible plan for spending the massive reserves the District has stockpiled due to inaccurate budgeting. And moving forward, we must ensure that SFUSD is a good steward of the public dollars we’re entrusted with, spending today's dollars on today's students each and every year. This means hiring full-time staff instead of contracting out, prioritizing services that are closest to students, and stabilizing our schools because our students learn best when schools are safe and predictable. It’s time to face the reality that SFUSD’s budgeting has been wildly inaccurate for years, predicting deficits that don’t materialize and harming our students. It’s time to get SFUSD’s fiscal house in order. Our students can’t wait: It’s time for us to deliver the public schools they deserve.

The following PROPEL contributors and school budget experts contributed to the research and analysis of this policy position paper: Maggie Furey - School Social Worker, Matt Alexander - Board of Education Member, Chun Yin Li - SFUSD Family Liaison, Geoff Kent - Math and Computer Science Educator, Jodie Sheffels - Math Educator, Roberto Guzman - Parent Leader, Ali Uscilka - Parent Leader

Sources

2020-21

$60 million Unrestricted General Fund deficit was predicted in January 2020 (SFUSD Budget Update 1/8/20, slide 13)

Actual result was a $65 million surplus, with $20 million listed as unrestricted. Ending fund balance was $128 million (2020-21 Unaudited Actuals, pages 7-8)

2021-22

$75 million Unrestricted General Fund deficit was predicted in December 2020 (SFUSD Budget Update 12/2/20, slide 4)

Revenue projection was $809 million in December 2020 (First Interim Report Dec 2020, page 63) Actual revenue for the year was $1,311 million, resulting in a $148 million surplus, with $118 million listed as unrestricted. Ending fund balance was $275 million. (2021-22 Unaudited Actuals, pages 9- 10)

2022-23

$125 million overall deficit was predicted in December 2021 (SFUSD Budget Balancing Plan 12/14/21, slide 4); balancing plan included $90 million in proposed cuts

Revenue projection was $1,023 million in December 2021 (First Interim Report Dec 2021, page 29) By March 2022, the proposed cuts were $50 million, and there were hundreds of layoffs (Budget Update 3/2/22, slide 14; layoffs approved at BOE 3/1/22)

Actual revenue for the year as $1,242 million, resulting in a $120 million surplus, with $42 million listed as unrestricted. Ending fund balance was $413 million. (2022-23 Unaudited Actuals, pages 1-3)

2023-24

$31 million Unrestricted General Fund deficit was predicted in December 2022 (SFUSD Budget Update 12/13/22, slide 9)

Revenue projection was $1,183 million in December 2022 (First Interim Report Dec 2022, page 137) Actual revenue for the year was $1,268 million, resulting in a $40 million surplus, with $8 million listed as unrestricted. Ending fund balance was $468 million. (2023-24 Unaudited Actuals, pages 7- 8)

2024-25

Revenue projection was $1,159 million in December 2023, with $162 million overall deficit (First Interim Report Dec 2023, page 126)

Actual revenue was $1,241 million, resulting in a $37 million deficit, with $6 million listed as unrestricted. Ending fund balance was $429 million. (2024-25 Unaudited Actuals, pages 6-7)